Frequently Asked Questions

Don’t speak fluent healthcare? We can translate. Find answers to frequently asked questions here.

FAQs

What does UHA stand for?

University Health Alliance.

How did UHA get its name?

In 1996, a group of physician teachers at the University of Hawaii John A. Burns School of Medicine decided to make a difference. They created the University Health Alliance to bring a simpler, more caring approach to employee health insurance. Since then, UHA has grown to offer the largest physician network in Hawaii.

What do you mean by Better Health, Better Life?

We believe good health is one of the keys to living the best life possible. That’s why we were the first health insurer in Hawaii to provide 100% coverage for wellness and preventive medicine, including annual physical exams, seasonal flu vaccines and a variety of health screenings. Better health leads to a better life.

How easy is it to switch to UHA from HMSA?

It’s actually a straightforward process. Here are the details:

1. You get a quote from us.

2. You agree to the quote and pay the first premium.

3. You enroll your employees.

4. We send the member ID cards to each of your employees.

That’s all there is to it!

How long does it take to switch to UHA?

Once you apply, our proposal will come back to you within a week. Enrollment times vary based upon your review time and the number of people in your employ. Your member ID cards will arrive 5 to 10 days later. Check out our Timeline.

I saw that ad about nurse visits, does everybody get a nurse visit?

Not everybody needs a nurse visit. But when your condition is being managed due to complications or serious diagnosis we come by and offer our help and advice.

Do you offer Medicare products?

No, we don’t.

My rates keep going up at HMSA. Do your rates go up every year, too?

It is an unfortunate fact of life in the current healthcare industry that costs tend to increase from year to year. That said, we’ve done our best over the last several years to keep our rates as low as possible, even as factors out of our control — such as the cost of prescription drugs — have gone up.

Do you offer individual plans?

No. We offer business plans for companies of all sizes.

Do you offer an HMO plan?

No. All of our plans allow you to choose from our extensive list of providers. No insurance company in Hawaii has a larger provider network than UHA’s.

How financially secure is your company?

Very secure. We consistently maintain at least double the state-required amount of financial reserves.

HMSA gets approvals for procedures from a mainland company. Do you?

No, we don’t. All decisions on services requiring prior authorizations are made in-house, right here in Hawaii. This frequently results in shorter pre-authorization times.

What is your average approval time for prior authorizations?

All prior authorizations are done within two weeks. Online submissions take about a week, and urgent situations are handled within 72 hours.

What does [health insurance term] mean?

Here’s a partial list of some commonly used health coverage and medical terms.

What is the Transparency in Coverage and No Surprises Act?

Refer to our overview here for details.

I am a new Human Resources (HR) person handling the medical benefits for my company. How do I add myself as an authorized Group Administrator?

To add or remove an authorized Group Administrator, please complete a Group Information Change and Online Authorization Form and send it to UHA. Please note that the form must be signed by a company officer or a person who is already an authorized Group Administrator. You cannot add yourself unless you are a company officer. If you are interested in signing up for access to our online portal (for enrollment, bill view and/or bill pay services) please use the above form.

How do I update my group's billing address, mailing address, phone number, or email address?

Please fill out a Group Information Change and Online Authorization Form. The form must be completed and signed by an authorized group administrator. Once complete, please fax to 1-877-222-3198 or email to UHA Employer Services or your Client Services representative for processing.

When am I allowed to enroll an employee?

You can enroll employees during any of the following Qualifying Events:

- When a new employee is hired;

- Your group’s annual open enrollment period;

- When an employee becomes eligible for coverage (ex: an employee goes from part time to full time status); or

- When an employee loses coverage elsewhere.

Please note that enrollments & terminations must be received within 31 days of the qualifying event. Enrollments are always effective the first of a given month and terminations are always effective on the last day of a given month.

Enrollment forms can be faxed to 1-877-222-3198 or emailed to UHA Employer Services. You can also sign up for the Online Employer Services System and enroll members 24/7 on our safe and secure portal.

Detailed information about eligibility and qualifying events can be found in the Group Administrator Handbook.

How do I add an Eligible Dependent (employee's newborn child, adopted child/children, stepchild/children, newlywed spouse or civil union partner) to the plan?

To enroll an eligible dependent, please complete a Member Enrollment Form. The completed form and the appropriate documents should be submitted to UHA by the Group Administrator. Additions to your health plan must be enrolled within 31 days of births, adoption, marriage, or civil union.

For more information regarding Eligible Dependents, please refer to your Group Administrator Handbook.

Are there deadlines for submitting changes to the group?

Changes to the group’s benefits can be made each year during open enrollment. UHA will send a letter 60 days prior to your renewal date and changes are due at least 30 days prior to your group’s renewal date. Please refer to the Group Administrator Handbook.

How do I terminate coverage for an employee or their dependent(s)?

A member’s coverage can be terminated by using the Member Termination form. Employee eligibility under most medical benefits programs terminates on the last day of the month in which employment ends. Mid-month terminations or retroactive terminations will not be accepted.

I terminated an employee's coverage but now I need to reverse the cancellation. What do I do?

If you terminated an employee’s coverage by accident, or circumstances have changed and they should not be terminated, you can re-enroll them with no break in coverage if the termination date has not yet passed. The quickest way is to re-enroll them is through UHA’s Online Employer Services System or by sending in a completed Enrollment Form. If the termination date has already passed, please contact us at (808) 532- 4000, extension 299.

I enrolled an employee for next month but it turns out he/she will not be eligible. What do I do?

Please complete the Member Termination Form stating the termination date as the day before coverage is going to be effective and send an email to UHA Employer Services or via fax to 1-877-222- 3198 with an explanation.

Until what age does UHA cover dependent children?

UHA will cover all eligible dependent children up until their 26th birthday. If an employee’s dependent is certified as disabled, the dependent may continue coverage after UHA has reviewed and approved enrollment of a completed Disability Certification Form.

My employee is Medicare eligible and will be going onto a Medicare plan and terminating UHA coverage, but his/her or civil union partner spouse is not Medicare eligible yet. Can the spouse keep UHA coverage?

Unfortunately, if the employee is not enrolled with UHA, dependents cannot keep UHA coverage.

My employee (or their dependent) has become Medicare eligible. Is there anything we need to do?

If any of your members become eligible for Medicare, please have them visit the Medicare website for information. Generally, signing up for Medicare can help the member reduce their out-of-pocket costs for medical services, especially when travelling outside the state of Hawaii.

How does UHA handle COBRA enrollment and billing? Does UHA bill the COBRA member directly?

Please refer to our special COBRA Information section.

Our company offers or will be offering both UHA 3000 and UHA 600, and our open enrollment period is coming up. How does an employee switch plans?

If an employee wants to switch between plans at the time of open enrollment, you can submit the Member Change Form or make the change via the Online Employer Services System. If you are sending a PDF form please send it to UHA Employer Services or via fax to 1-877-222-3198. If you would like to conduct open enrollment sessions please make sure to contact your Client Services representative and we will be happy to assist.

How long does it take to get a Member ID card?

Member ID cards are usually mailed within 5 business days after an enrollment or request for a card has been received.

How can an employee or their dependent(s) get a replacement Member ID card?

Your employee can:

- contact Customer Services

- or email UHA via our online form

- or complete and fax a Member Identification Card Request Form

If they register for Online Member Services, they can print out a temporary ID card.

Will dependents receive Member ID cards?

Each subscriber (employee) is issued two UHA Member ID Cards. The cards list the name of the subscriber and each dependent’s name. Please see previous question, “How can an employee or their dependent(s) get a replacement Member ID card?” for information on how to order additional UHA Member ID cards.

I did not receive my billing statement. Why?

It could be either of the following reasons:

- If your business moved recently, we may still have your old address in our system. Please contact your dedicated Client Services representative to update your mailing and physical address with UHA any time you have a demographic change. You will need to complete and submit a Group Information Change and Online Authorization Form.

- If you are registered for Online View Bill access, paper billing statements are not sent.

Why am I still getting billed for an employee I removed from coverage last month?

Because of the state’s Prepaid Health Care law, UHA bills for premiums in advance. For example, the January bill is generated and sent in December. Any changes you make after the bill is generated will not show up until your next bill. For example, if an employee leaves on December 15th and you terminate his coverage, he will still appear on your January bill because the bill was already generated. The credit will appear on your February bill that you receive in January. For further assistance, please contact UHA’s Billing Department at (808) 532-4000, extension 353.

What is the best way to send my premium payment to UHA?

There are several ways you can send your payment to us besides mailing it:

- UHA’s Online Employer Services System

You can submit your payment online every month or set up scheduled monthly payments. If you aren’t signed up yet, you can register by submitting the Group Information Change and Online Authorization Form. - Monthly Electronic Funds Transfer (EFT) Automatic Deduction (AD)

You can set up EFT by filling out the Authorization for Electronic Funds Transfer (EFT) Employer Group / COBRA Member Form and sending it to UHA’s Billing Department. Withdrawals are processed on the 1st of each month. - Direct Deposit into UHA’s Bank of Hawaii account

Please contact UHA’s Billing Department at (808) 532-4000, extension 353 for more information.

How can I find out if my payment was received?

You can check your group’s account status using UHA’s Online Employer Services System. The account balance is updated every 48 hours. You can also contact a billing representative at 808-532-4000 extension 353 to confirm whether your payment was received. Please have your group number, payment amount and check number ready. If you made a direct deposit for your payment, please have your receipt handy for reference.

Some of my employees want drug, vision and/or dental coverage, but others just need medical. Is it possible to have more than one benefit option?

It is important that you are aware of the requirements of the Hawaii State Department of Labor. As of January 2014, Health Care Reform requires some employers to provide certain minimum benefits to all eligible employees. Please contact your Client Services representative or broker for more guidance.

Since the Hawaii state law only requires employers to contribute to the single medical premium, can I pass on the cost of the drug, vision and/or dental premiums to my employees?

We suggest contacting the Hawaii State Department of Labor for official clarification.

The Hawaii State Department of Labor said I need to have an HC-15 submitted to prove that we are in compliance. What do I do?

UHA submits a monthly report to the DOL for all new groups, reinstating groups, and terminated groups. If you have been asked to have an HC-15 submitted, you can contact your Client Services representative to check to ensure that your group was reported or to find out when your group will be reported to the DOL to verify your company’s active contract for medical insurance.

How do I request a Schedule A/Form 5500?

Contact your Client Services representative to request the document. Please be specific about the data period you are requesting and who UHA should send it to. A new request must be sent each year. Schedule A/Form 5500s will be made available at the earliest 120 days after the last day of the requested data period.

Does signing the Schedule of Benefits lock me into a 12-month contract? Do I have to wait until my renewal to terminate coverage?

Signing the Schedule of Benefits secures your rates and premiums for 12 months or the stated period of time. You may still terminate your contract before the 12 months are up, but there are some limitations and requirements. Please refer to Article 7 of your Standard Agreement for Group Health Plan for more details.

How do I sign up for online access? Are there limitations?

To sign up, please complete and submit a Group Information Change and Online Authorization Form. The only limitation is that only one authorized user can have Full Access because “Full Access” includes Online Bill Pay.

How soon will I see the Enrollments, Terminations or Changes I made in Online Enrollment?

Online Enrollment takes two business days to reflect on the Online Enrollment site. For example:

- Tuesday – Enrollment Request entered in Online Enrollment

- Wednesday – Enrollment Request is submitted to UHA

- Thursday – The Member will appear in your Online Enrollment account. (The site takes 24 hours to refresh)

I'm having difficulties logging into Online Enrollment/Online Billing. Who do I contact for assistance?

For assistance with logging into your Employer Portal, please call an Enrollment representative at (808) 532-4000, ext. 299.

What do I need to get a quote?

In order to receive a quote, please submit a completed Employer Application & Certification Form (available as an online form or PDF) along with a completed Census Form. The Census Form can also be submitted as an Excel file.

- Employer Application and Certification Form (online form) (PDF)

- Census Form – Small Group (PDF)

- Census Form – Large Group (Excel)

Requests can be sent to Client Services or via fax to 1-877-222-3198.

Can I change between UHA benefit plans at any time?

Once you select a plan, you must remain in the plan until your group’s next open enrollment period. Open enrollment period occurs annually. See your company’s Human Resources Director for your open enrollment period.

Does UHA have any pre-existing condition clause?

UHA does not have any pre-existing condition clause.

What do I do if I have a pre-existing condition and would like to continue my treatment plan?

If you are a new member to UHA and are currently on a treatment plan, have your physician contact Health Care Services to discuss a treatment program to ensure there is no lapse in your medical services at 808-532-4006.

Also, ask your Human Resources Director for a UHA Transition Coverage Questionnaire or access it on our Forms and Documents page, under the Employer Forms tab. Completing and submitting this form will ensure continuation of your care during the transition period.

Who is responsible for notifying UHA regarding hospital outpatient or inpatient services?

Participating physicians are responsible because they have the necessary information to complete the notifications, i.e., diagnosis and procedure codes. If you have elected to receive your care from a Non-Participating provider, you become primarily responsible for this prior notification to UHA.

Who do I notify if I have an urgent authorization request?

Contact Health Care Services at 808-532-4006.

My physician has referred me to a specialist on the mainland. May I receive coverage for these services?

Your physician must submit an Out-of-State Services Request Form at least 2 weeks in advance.

We advise that you do not make travel arrangements until the review is completed and you and your referring physician receive written confirmation from us that the service will be covered. Benefit coverage information will be provided only after the review is completed. Airfare and lodging are not covered benefits.

Contact Health Care Services with any questions at 808-532-4006. For more information, please view Receiving Care Outside of Hawaii.

I would like to get a second opinion from a mainland provider. Is it a covered benefit?

Providers outside of Hawaii are not contracted with UHA, therefore, non-participating provider benefits will apply. This means UHA will pay only up to our eligible charge for non-participating providers, which is based on our rate for similar services performed in Hawaii. You are responsible for the difference between UHA’s payment and the provider’s actual charge (“balance billing”), which can be substantial.

Members are encouraged to obtain their second opinion within the State of Hawaii, which is covered at 100% of the eligible charge. If you are considering out-of-state services, please contact Health Care Services to discuss your options at 808-532-4006.

How do I submit claims for medical services received from a non-participating provider?

Any claim or receipt for services submitted to UHA for payment must include the following information and can be sent by mail or fax.

Step 1: Make sure your claim has all required information.

- Your member identification number from your identification card; if not available, patient’s date of birth is required

- The provider’s full name and address

- The patient’s name and address

- The date(s) services were received

- The charge for each service (in U.S. currency)

- A description of each service (UHA uses the nationally accepted CPT-4 and HCPCS procedure codes)

- A diagnosis or type of illness or injury (UHA uses the nationally accepted ICD-10 diagnostic codes)

- If applicable, information about any other health coverage you have

If submitting claims from providers in a foreign country:

- All claims submitted from a foreign country for reimbursement must be translated into English.

- If the bill was paid with foreign currency, the rate of exchange applicable on the date of service must also be supplied to UHA.

The above information must be from your provider (statements you prepare, cash register receipts, receipt of payment notices or balance due notices cannot be accepted). Without the required information, claims are not eligible for benefits.

Step 2: Send your claim and required documentation to UHA by mail, fax or online.

Claims should be submitted to us as soon as possible after the date of service. All claims for payment for services must be filed with UHA within one year of the date of service. UHA will not make payment on any claim received more than one year after the date on which you received the service.

Submit by mail or fax:

- Via Mail: 700 Bishop Street, Suite 300, Honolulu, HI 96813

- Via Fax: 866-572-4393

Please note that UHA is not responsible for the loss of any receipts. Always keep a copy of everything submitted with your claims.

For assistance with submitting your claim, call Customer Services at: 808-532-4000, Toll free: 1-800-458-4600.

How do I file a vision claim for services from a non-participating provider?

Send your receipt or invoice and copy of your UHA medical card:

- Via Mail: 700 Bishop Street, Suite 300 Honolulu, HI 96813

- Via Fax: 866-572-4393

All claims must be filed within one year from the date of service; claims filed after one year will not be paid.

If you have any questions about your vision plan benefits, contact Customer Services at: 808-532-4000, Toll free: 1-800-458-4600 from the neighbor islands.

What is an EOB?

An Explanation of Benefits (EOB) is generated after your claim has been processed. The EOB tells you how much your health plan covered. It describes how we processed the claim, including the services performed, the amount charged, our eligible charge, the amount we paid, and the amount, if any, that you owe under the health plan benefits. It is not a bill. If you have a financial obligation to providers, they will usually send you a bill. If we denied the claim or any part of it, the EOB will provide an explanation for the denial.

The EOB covers a one-month period. The EOB month is when the claim was processed, not necessarily the month you received the service.

How do I view my EOB(s) online?

- Go to uhahealth.com, click “Log In” at the top of the page, then click “Member log in.”

- If you have an Online Member Services account: Enter the username and password you used to create your account to log in to Online Member Services.

- If you do not have an account: Please register here (make sure to have your UHA member ID number ready), then log in.

- Click on “EOB” in the menu at the top of the page. EOBs are listed by month with the newest at the top.

You will need Adobe Reader to view your EOBs. Download Acrobat Reader free of charge at get.adobe.com/reader.

I have a young child that recently used their benefits. Where is their EOB?

Each family member will receive an EOB electronically through their individual Online Member Services account. You or your family member will need to log in to your individual accounts to review your EOB(s). If you do not have an Online Member Services account, please register here to create one.

Why did I get notified of a family member's EOB?

You and the family member have the same email address. Because of this, your family member will also be notified when you have an EOB available. If you wish, you may set up your own email address so only you will be notified when an EOB is available.

Can a claim be reconsidered?

Yes, claims can be reconsidered for a variety of reasons. Please contact Customer Services for assistance.

What if I am not satisfied with the decision of my reconsidered claim?

If you are not satisfied with our response to your concern, or do not wish to request informal reconsideration, you must file a formal appeal. The appeal must be filed within one year of the date UHA informed you of the denial or limitation of the claim or coverage for any requested service. Appeals must be submitted in writing to:

UHA Appeals Coordinator

700 Bishop Street, Suite 300

Honolulu, HI 96813

Your appeal will be reviewed by staff not involved in the original decision (nor a subordinate to the original decision maker). If the appeal concerns a clinical matter, it will be reviewed by an independent licensed practitioner with appropriate expertise and experience. If we need additional information to complete our review, we will notify you and give you reasonable time to respond.

For more information, please view How to Initiate An Appeal.

The final decision will be made by the UHA Appeals Committee. You will be notified of the final decision within 60 days of receipt of your written appeal, or within 30 days if your appeal concerns a denial of a clinical matter.

Expedited Appeals

You may request an expedited appeal if the standard time (30 or 60 days, as set forth above) for completing an appeal would:

- seriously jeopardize your life or health,

- seriously jeopardize your ability to gain maximum functioning, or

- subject you to severe pain that cannot be adequately managed without the care or treatment requested

You may make your request for expedited appeal by calling Health Care Services at 808-532-4006. If a health care provider with knowledge of your condition makes a request for an expedited appeal on your behalf, we do not require a written authorization from you.

Who can request an appeal?

You or your authorized representative may request an appeal. Those include:

- any person you authorize to act on your behalf as long as you follow our procedures. This includes filling out a form with us

- a court-appointed guardian or agent under a health care proxy

- a person authorized by law to provide substituted consent for you or to make health care decisions on your behalf

- a family member or your treating health care professional if you are unable to provide consent

To designate an authorized representative to act on your behalf with UHA, you must submit to UHA the Authorized Representative Form. This form must be completed and returned to UHA’s Appeals Coordinator before an appeal request can be considered.

What if I am still not satisfied with the final decision of my appeal?

If you are not satisfied with the final decision of the UHA Appeals Committee, you have the following external appeal rights:

If you disagree with an appeals decision regarding medical necessity, appropriateness, or experimental or investigational services, you may request external review of the decision by an Independent Review Organization (IRO) assigned by the State of Hawaii Insurance Commissioner. This request must be submitted in writing to:

Hawaii Insurance Division

Attn.: Health Insurance Branch – External

Appeals 335 Merchant Street, Room 213

Honolulu, HI 96813

Your request must include the following documents:

- Request for External Review by IRO

- External Review HIPAA Authorization Form

- Disclosure for Conflicts of Interest Evaluation

If you do not elect to request review by an IRO, or if you disagree with an appeal of any other decision, your options for external review vary depending on your plan. For more information, please view If You Disagree With Our Final Appeals Decision.

What is the difference between "participating" and "non-participating" providers?

Participating providers have a signed contract with UHA, and receive reimbursement of eligible charges directly from UHA. From a member perspective, only a co-payment, deductible, applicable state excise tax, co-insurance, and payment for non-covered items (if any) may be required at the time of service.

All other providers, without signed UHA contracts, are considered non-participating providers. Non-participating providers may collect their full charge(s) from the member at the time of service.

How can I find out if my healthcare provider is a participating provider?

Participating providers can be found in our Care Provider Search tool on the UHA website here.

UHA’s directories are subject to change. For verification of the most current provider participation status, call Customer Services at: 532-4000, Toll free: (800) 458-4600.

How do I get reimbursed for services received from a non-participating provider?

Members are responsible for the total amount billed, usually at the time of service. UHA will make payments for covered services directly to the subscriber of the plan. Reimbursements will be at the UHA non-participating benefit level and based on UHA’s eligible charge. At our sole discretion, however, we will make payments directly to non-participating facilities for services. Therefore, the member is responsible for the difference between the billed charges and the amount of UHA’s reimbursement, including any applicable co-payments, co-insurance, or deductible.

UHA will not accept invoices or receipts as claim forms for services rendered in the U.S.

*Standard claim forms are:

- Inpatient/Outpatient facilities – UB-04 CMS-1450

- Professional/Other services – CMS-1500 (08-05)

- Prescription drugs – DAH 3PT-1000

How do I get reimbursed for emergency services received in a foreign country?

Traveling to a foreign country for the purpose of receiving services is not a covered benefit, even if referred by your physician. Only emergency medical services performed outside the U.S. will be covered if they meet appropriate criteria.

Claims for services rendered by a foreign provider must be fully translated to English and must contain:

- Patient’s name

- Patient’s date of birth

- Diagnosis

- Procedures done with dates of service and charges (listed separately)

- Name and address of the provider of service

- Name and address of the facility where services were rendered

- Your receipt of payment made, converted to U.S. Dollars and the rate of exchange on the dates of service

In certain instances, we may require additional documentation such as admission and discharge summaries, or daily hospital records.

If I should become injured or ill while traveling within the U.S., will my medical care be covered?

Yes. If you become injured or ill while traveling within the U.S., any emergency care, urgent care, or hospitalization will be covered according to your plan benefits. Through our relationship with UnitedHealthcare, you have access to UnitedHealthcare’s Options PPO Network, and seeing a UnitedHealthcare participating provider can significantly limit your out-of-pocket expenses. We recommend checking to see if there is a UnitedHealthcare participating provider in the area of travel.

Treatment for a condition which occurred or was diagnosed before your trip will be subject to the same prior authorization requirements as any non-emergent treatment outside of the State of Hawaii. Contact Health Care Services with any questions.

If I am attending college, working, or living on the mainland, or on COBRA, how do I facilitate my medical care?

Notify Employer Services regarding your out-of-state address.

You also have access to UnitedHealthcare’s Options PPO Network, a mainland network of providers, and one of the nation’s largest and most respected national PPO networks. Selecting a UnitedHealthcare participating provider is a benefit to you and provides a significant cost saving over a non-participating provider.

Who is considered a dependent?

The following are considered eligible dependents:

- The spouse or Civil Union Partner of the employee

- Dependent children up to age 26 regardless of marital status, enrollment in school, or residency

Please note: Spouses and children of adult dependents do not qualify for this coverage - Unmarried children who are disabled and have a verifiable disability

- Other categories of dependents are subject to the provisions of the employer’s Group Service Agreement. Please consult with your employer for questions about dependent eligibility.

How do I add my newborn child, adopted child, newlywed spouse or Civil Union Partner to my plan?

To enroll your newborn child, adopted child, newlywed spouse or Civil Union Partner, complete a Member Enrollment form. The form along with the appropriate documents should be submitted by the group administrator to UHA. Additions to your health plan must be enrolled within 31 days of birth, adoption, marriage, or civil union.

I lost my member ID card. How do I get a new one?

You may either contact Customer Services, email us via our online form, complete and fax a Request for Member Identification Card form or visit our Member Portal where you can register and print a temporary card.

How long does it take to get a member ID card?

Member ID cards are usually mailed within five to seven business days after an enrollment or request for a card is received.

Will my dependents receive member ID cards?

The subscriber will receive two ID cards. The cards list the name of the subscriber (employee) and each dependent’s name. Additional ID cards can be requested through Customer Services at 808-532-4000.

What can members expect from UnitedHealthcare’s Options PPO Network?

UHA’s primary service area and provider network remains in Hawaii where the best care for your needs is likely to be right here at home. However, when you or your ‘ohana do travel away from Hawaii to temporarily visit the U.S. mainland—whether that’s for study, travel or work—UHA has our members covered for emergency medical care.

Through our relationship with UnitedHealthcare, UHA offers access to quality medical care from UnitedHealthcare’s extensive U.S. mainland network of providers, as well as online tools and resources to help members find the right care during their travels.

Does the UnitedHealthcare (UHC) network include international healthcare coverage and benefits?

No. Through the UHA Health Insurance benefit plan, members have access to the UnitedHealthcare Options PPO Network, which is available only on the U.S. mainland.

How do members find a provider in the UnitedHealthcare network when on the mainland?

Use the UnitedHealthcare online provider directory at UHAHealth.com/mainlandnetwork.

By using UnitedHealthcare’s mainland provider network, our members will have access to quality health care resources to support all of their health-related needs while on the U.S. mainland.

Note: when at home in Hawaii, members utilize the UHA provider network. To find a convenient provider in Hawaii, go to UHAhealth.com and click on Find Care Providers & Drugs at the top of the screen or call Health Care Services at 808-532-4006 for assistance locating a provider who is accepting new patients.

How do Complementary and Alternative Medicine (CAM) benefits and services work under the UnitedHealthcare network?

UHA will follow UnitedHealthcare’s network for Chiropractor, Therapeutic Massage Therapy and Acupuncture services. If a provider is participating within the UnitedHealthcare network, the CAM benefits will be covered assuming the services meet UHA’s criteria for payment.

Note: when at home in Hawaii, members utilize the UHA provider network. To find a convenient provider in Hawaii, go to UHAhealth.com and click on Find Care Providers & Drugs at the top of the screen or call Health Care Services at 808-532-4006 for assistance locating a provider who is accepting new patients.

Where is the UnitedHealthcare provider directory located?

Visit UHAHealth.com/mainlandnetwork. Simply search the UnitedHealthcare online provider directory and locate a doctor or facility when on the U.S. mainland.

We created that dedicated online page for members to access UnitedHealthcare’s extensive provider network and quality health care resources to support all their health-related needs while away from home in the event of an emergency or if a dependent is living on the mainland for school.

*Insurance coverage is provided by UHA Health Insurance. The administrative services are provided by United HealthCare Services, Inc.

How does Express Scripts help me manage my medications?

With Express Scripts you have access to pharmacists who have expertise in the medications for high blood pressure, asthma, diabetes or cancer. Pharmacists at Express Scripts can help with questions about your medications. The pharmacists can also advise you how to potentially reduce your medication costs.

When you log into your Member Portal at UHA, either on the website or the mobile site, you can also access your current prescription information with Express Scripts. You may also log in directly to Express Scripts at express-scripts.com or by calling the number listed below.

- Customers calling about their prescriptions: 855-891-7978

- Pharmacists (for Rx or PA information): 800-922-1557 or 800-753-2851

- Providers (for PA): Express PAth

Your doctor can call in a prescription over the phone or enter the information on the website. In most cases, your doctor will get a real-time response.

Do I have to call Express Scripts, or can I call UHA's customer service line?

It is best to contact Express Scripts directly with questions about your copay or out of pocket costs. UHA’s phone lines are also available 8 am to 5 pm, Monday – Friday, except for major holidays. A representative can be reached at 808-532-4000 (or 800-458-4600 from the neighbor islands) at the extensions below:

- Customer Services: or 800-753-2851 ext. 297

- Health Care Services: ext. 300

- Employer Services: ext. 299

- Premium Billing: ext. 353

How do I get a new or replacement member ID card?

Should you misplace or not receive a new card, you may submit a request via our website or call our Customer Services department at 808-532-4000 or 1-800-458-4600 (from the neighbor islands). Your card will have the following information that your pharmacy needs to process your prescription(s):

RxBin: 003858

RxPCN: A4

RxGroup: NKTA

Please note that your drug plan may be self-insured by your employer or you may not have a drug benefit.

Do I need to show my member ID card at the pharmacy?

Yes. This is very important in order to avoid delays in processing extended or autofill prescriptions, as the pharmacy may not update the information until the member receives a rejection. The key is to give your pharmacist these numbers:

RxBin: 003858

RxPCN: A4

RxGroup: NKTA

These are the same for everyone with UHA drug coverage.

How do I submit my receipts for prescriptions that I paid for out of pocket?

You may submit your receipts by fax directly to Express Scripts at 877-329-3760. There is a direct member reimbursement form (DMR) located on the Express Scripts website that you may send with your receipts that will ensure timely reimbursement (submit receipts within 90 days from date of purchase).

How do I file a Drug Claim from a Non-Participating Provider?

Non-participating pharmacies may require you to pay for your prescription in full and have you file your claim with UHA. You can submit your receipts for reimbursement via fax to Express Scripts at 877-329-3760. There is a direct member reimbursement form (DMR) located on the Express Scripts website that you may send with your receipts that will ensure timely reimbursement. You should note that the reimbursement is likely to be less than if you used a participating pharmacy.

How does extended fill or mail order work?

UHA members may obtain an extended supply of their maintenance medications at most UHA-participating retail pharmacies within the Express Scripts network.

For mail order services, members may enroll in Express Scripts Home Delivery. Manage your prescription orders via a single login using your UHA Online Member Services account. Call 800.282.2881 to contact Express Scripts’ Patient Customer Service if you need help enrolling. Learn more on our Prescription Drugs page.

How do I get vaccinations?

You can either get vaccinations at your doctor’s office or at a pharmacy in network.

Why do some drugs need prior authorization (PA)?

If a pharmacist tells you that your prescription needs a PA, your doctor should contact Express Scripts to be sure that drug is right for you. We also need to check if your plan covers the drug. This is similar to when your healthcare plan authorizes a medical procedure in advance.

When a prescription requires a PA, your doctor can call Express Scripts or prescribe a different drug that is covered by the plan. Only doctors can give Express Scripts the information they need to see if the drug is covered. Express Scripts answers PA phone lines 24 hours a day, seven days a week. A decision can be made right away. If the drug is covered, you will pay your normal copayment. If you choose the medication that is not covered, you will pay the full price.

How do I request a rush review?

Your doctor can use eviCore portal online or submit a PA by phone. In most cases your doctor will receive a real-time answer. If approved, you will be able to pick up your medication right away.

What if I disagree with a decision made by Express Scripts?

If you disagree with a decision made by Express Scripts, your doctor may contact UHA’s Health Care Services department Monday-Friday, 8am to 5pm HST to request a peer-to-peer conversation within 30 days of the denial. We will arrange a time for your doctor to speak with our Medical Director or Chief Medical Officer. If you or your doctor would like to submit a written appeal, please follow our appeals process here.

Some drugs are managed under your medical benefits rather than by your pharmacy benefits. Some injectable drugs are reviewed by CareContinuum, an Express Scripts company. If you disagree with a decision made by CareContinuum, please contact them at (866) 877-7042, Monday-Friday, 8am to 5pm EST. With CareContinuum, your doctor will be able to request a peer-to-peer conversation or submit a written appeal.

How will UHA cover my medications if I also have other insurance coverage?

COB (coordination of benefits) claims may be subject to PA, which means if the drug or procedure needs a PA from UHA, even if UHA is the secondary insurer, the PA will still need to be submitted.

Primary insurance coverage applies to the original claim, but the member is responsible for the remaining balance. That amount will come in on a claim to UHA as the secondary insurer. Some examples are listed below:

Note: Primary insurance already paid on the claim, so the COB claim comes to UHA as secondary insurance.

| Example #1 | $30 patient responsibility

|

UHA pays $0 Member pays $30 |

| Example #2 | $30 patient responsibility

|

UHA pays $15 Member pays $15 |

| Example #3 | $500 patient responsibility

|

UHA pays $485 Member pays $15 |

| Example #4 | $500 patient responsibility

|

UHA pays $400 Member pays $100 |

Plans P, & S have $200 & $250 drug price limits respectively, which means the coinsurance will hit the “4th Tier 20% coinsurance requirement” if the drugs exceed those amounts.

I don't understand the difference between Generic, Preferred Brand and Non-Preferred Brand drugs. Please explain.

- Generic drugs are the lowest cost drugs; copies of patented Brand name drugs that have the same chemical action as Brand name drugs.

- Brand medications are either Preferred or Non-Preferred (sometimes referred to as Formulary or Non-Formulary).

- Preferred Brand drugs have a lower copay than Non-Preferred Brand drugs.

- Non-Preferred Brand drugs are newer drugs that are usually the most expensive drugs available among them all.

Can you explain what Step Therapy is?

Step therapy is for people who take prescription drugs daily to treat a long-term condition (arthritis, asthma, or high blood pressure). It lets you get treatment at a lower cost. It also helps your employer maintain prescription drug coverage for everyone your plan covers.

In step therapy, medicines are grouped in categories based on treatment and cost.

- First-line medicines are the first step. They are generic and lower-cost brand-name drugs approved by the U.S. Food & Drug Administration (FDA). They are proven safe, effective and affordable. Step therapy suggests you try these drugs first. In most cases they provide the same health benefits as more expensive drugs, but at a lower cost.

- Second-line drugs are the second and third steps. These are often brand-name drugs. They are best for patients who don’t respond to first-line drugs. Second-line drugs are the most expensive.

Generic drugs have the same chemicals as the brand-name. They also have the same effect. Though generics may have a different name, color and/or shape, they have been through the same testing as the original drug. They have also been approved by the FDA as safe and effective in the same manner as the original drug.

Unlike manufacturers of brand-name drugs, the companies that make generic drugs don’t spend as much money on research and advertising. As a result, generic drugs cost less than the original brand-name drug and the savings get passed on to you.

The first time you try to fill a prescription that isn’t for a first-line medicine, your pharmacist should explain that step therapy asks you to try a first-line medicine before a second-line drug. Only your doctor can change your current prescription to a first-line drug covered by your plan.

Can you explain what Quantity Limits are?

Quantity limits make sure that you get the right amount of medication and in the least wasteful way. For example, your doctor might have told you to take two 20mg pills each day. If that medication was also available in 40mg pills, our staff would ask the doctor to prescribe one 40mg pill a day instead of two 20mg pills. In addition, if the doctor wrote the original prescription for 30 pills (a 15-day supply), the new prescription for 30 pills would last a full month — resulting in just one copayment, not two.

If the prescription is for a larger quantity, the pharmacist can fill the prescription for the amount that the plan covers or contact the doctor to discuss other options. The pharmacist may increase the strength or get a PA for the quantity originally prescribed.

How do I add a physician to our practice?

Complete a Participating Provider Add Form and submit copies of the new physician’s Hawaii State and Federal DEA licenses (if applicable). Please include the provider group’s TIN (Tax ID Number) and NPI (National Provider Identifier) number(s).

Can I receive my reimbursements with an automatic deposit?

Yes. See the section on Electronic Funds Transfer (EFT).

How do I change my billing address?

Complete the Existing Provider Change form to report changes in billing address.

How often is the provider/physician fee schedule revised?

The provider/physician fee schedule is updated every two years, based on the prior year’s Medicare rates.

How do I report a change in company name and/or Federal Tax ID number?

Complete the Existing Provider Change form to report changes in company name and/or Federal Tax ID number, along with an updated W-9 form. If both have changed, please contact Customer Services as you may have to sign a new Provider Agreement.

My current Provider Identification Number (PIN) is my social security number. Can that be changed?

Yes. Send a request in writing and we will send you a new unique PIN number. Submit your request to:

UHA Contracting Services

700 Bishop Street, Suite 300

Honolulu, HI 96813-4100

Toll free fax: (866) 572-4383

Email: [email protected]

What is the patient co-pay for a physician office visit?

The patient’s UHA plan is listed on the member ID card. Currently the co-payments are:

UHA 3000 (Bundle): $12*

UHA One Plan℠ (Bundle): $12*

UHA 600 (Bundle): 10% of the eligible charge*

*Tax on the physician office visit charge is not a covered benefit. The provider is responsible for calculating the tax portion based on the eligible charge. Co-payment amounts are subject to change without notice.

Am I able to check claim status or claim payments online?

Online Claim status is now offered via Online Provider Services. For more information contact Customer Services at (808) 532-4000, or toll free at 1-800-458-4600 from the Neighbor Islands.

Are EDI claims submissions accepted?

Yes. There are two ways to submit EDI claim submissions. A connection can be made directly to UHA as an 837 transaction or through the Hawaii Xchange online service. Click here to read more about each submission method.

What is the procedure for submitting a claim, where Medicare is primary and UHA is secondary?

Submit the Medicare Explanation of Benefit along with the claim form to UHA.

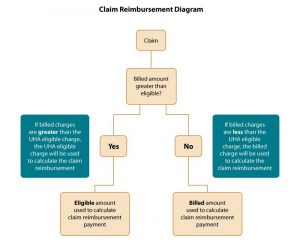

How do claims get paid based on billed charges?

Refer to the diagram below. Please contact Customer Services if you need further assistance.

Can a claim be reconsidered?

Yes, claims can be reconsidered for a variety of reasons. Please contact Customer Services for assistance.

What if I am still not satisfied with the final decision of my reconsidered claim?

If you are not satisfied with our response to your concern, and wish to pursue the matter further, you must appeal the decision by submitting a written appeal. The appeal must be filed within one year of the date UHA informed you of the denial or limitation of the claim or coverage for the requested service. Appeals must be submitted in writing to:

UHA Appeals Coordinator

700 Bishop Street, Suite 300

Honolulu, HI 96813

Your appeal will be reviewed by staff not involved in the original decision (nor a subordinate to the original decision maker). If the appeal concerns a clinical matter, it will be reviewed by an independent licensed practitioner with appropriate expertise and experience. If we need additional information to complete our review, we will notify you and give you reasonable time to respond.

For more information, please view our Provider Handbook.

The final decision will be made by the UHA Appeals Committee. You will be notified of the final decision within 60 days of receipt of your written appeal, or within 30 days if your appeal concerns a denial of a clinical matter.

Expedited Appeals

You may request an Expedited Appeal if the standard time (30 or 60 days, as set forth above) for completing an appeal would:

- seriously jeopardize the member’s life or health;

- seriously jeopardize the member’s ability to gain maximum functioning; or

- subject the member to severe pain that cannot be adequately managed without the care or treatment requested.

To request an Expedited Appeal, call Health Care Services.

What if I am still not satisfied with the final decision of my appeal?

If you wish to contest our decision on any appeal, you must agree to binding arbitration. To request binding arbitration, you must submit a written request for arbitration to UHA within 60 days of the date of the letter communicating the decision of the Appeals Committee. Both parties will agree on the person to serve as the independent arbitrator. The decision of the arbitrator is binding on both parties. Costs for the arbitration will be shared as ordered by the arbitrator. Further details are provided in your Participating Provider Agreement.

How do I refer a patient to a participating specialist?

Primary care physicians (PCP) and other participating specialists may direct members to any participating specialist. A formal referral is not necessary.

How do I refer a patient to a non-participating specialist?

Complete the Request for Authorization form or contact Health Care Services to discuss the referral.

Can another primary care provider (PCP) see my patient?

Yes. In order to meet the needs of our members, our plans allow for this kind of flexibility.

Is prior authorization required for mental health outpatient visits?

No.

Who is responsible for prior authorization for procedures performed by a specialist?

The specialist that will be performing the procedure is responsible for obtaining authorization by completing a Request for Authorization form. The primary care physician (PCP) should also be notified.

How are approved requests for authorization confirmed?

Providers who have registered for Online Provider Services* may view the status of authorization requests online. Otherwise, approved requests are confirmed in writing and delivered either by mail or fax. You must receive more than verbal notification for non-emergency care.

* For more information about Online Provider Services, please click here.

How long does it take to get an authorization approved?

We ask that you submit your prior authorization well in advance of the service date(s), allowing two weeks (15 days) for a determination to be made.

May I submit an expedited request for prior authorization?

You may, but be aware that expedited requests are defined as those which may seriously jeopardize life or health, or the ability to regain maximum functioning.

May I submit a request for authorization after a procedure has been performed?

Not typically, but requests will be handled on a case-by-case basis. Complete a Request for Authorization form and submit it for consideration.

Tip #1: How to Avoid Returned Claims

Reduce the time it takes to process your claim and avoid a returned claim by completely and correctly filling in the claim form.

The following items, if missing or incorrect, will delay processing of your claim or even result in a request for re-submission:

- Subscriber’s name

- Subscriber’s member ID number (11-digits)

- Patient’s name and date of birth

- Date of service

- UHA group number (4-digits)

- Name of referring physician for claims from laboratories, radiologists, and consultants

- Date, place, and cause of injury

- Descriptive diagnosis and ICD-9 code

- Descriptive procedures and CPT code

- Charges

- Provider’s billing name and address

- Provider or agent’s signature

- Supportive data for modifiers, e.g. after-hours modifier – claim should have time listed

- Provider Identification Number (PIN)

- Federal tax ID number

Tip #2: Coding Corner

Avoid the following possible claims(s) denials:

- Claim submitted with Modifier -25 or -57?*

- Tip: Submit your claims with supporting documentation indicating a significant, separately identifiable evaluation and management service by the same physician on the same day of the procedure or other service.

- Claim submitted with Modifier -59?*

- Tip: Submit your claim with supporting documentation indicating the service was distinct or independent from other service(s) performed on the same day.

- Claim submitted with duplicate CPT codes?*

- Tip: Submit your claim with supporting documentation indicating the service(s) is not a duplicate.

- UHA is secondary insurance carrier?*

- Tip: Submit your claim with primary insurance carrier’s EOB (Explanation of Benefits)/RA (Remittance Advice).

*You may also apply this information for previously denied claims resubmitted for reimbursement reconsideration

Tip #3: How to Complete the CMS-1500 Claim Form

Box 21 – DIAGNOSIS OR NATURE OF ILLNESS OR INJURY – ICD INDICATOR

Use the ICD-9 or ICD-10 code for each current diagnosis applicable to that visit. Do not put any description for each diagnosis code. The new form requires that codes be entered in the correct order following the alphabetical reference numbers (A-L) codes are entered left to right (alphabetical order), 4 codes per row, and up to 3 rows. NOTE: This is different from the old CMS form where only up to 4 codes can be entered and according to the numerical order.

UHA recommends that the diagnosis reference numbers (A-L) be used in COLUMN 24E to correspond with the services.

“ICD IND” Use this space to indicate if the diagnosis codes being used are ICD-9 or ICD-10 codes. An indicator of “9” would represent ICD-9 codes and a “0” indicator would represent ICD-10. This is a required field.

Please contact Customer Services if you require assistance.

Tip #1: Common Reasons for Claim Denials

Here are three common reasons a claim may be denied and some helpful tips to get your claims paid without delay:

- Denial Reason: “Duplicate claim”:

- Check other claims to see if the service was paid on another claim;

- If the service in question was not paid on another claim:

- Do NOT resubmit the same claim.

- Instead, submit the Provider Claims Action Request form with clinical notes.

- Denial Reason: “Exceeded timely filing”:

- Submit the Timely Claim Filing Waiver Form for providers with supporting documentation.

- Denial Reason: “No Prior Authorization on file”:

- Submit the Prior Authorization Request Form for appropriate services with clinical notes for retroactive review:

- Reference list of Services That Require Prior Authorization

Tip #2: Timely Filing Waivers

Acceptable reasons for timely filing waivers:

- Claim submission within 12 months from date of service

- Claim submission within 12 months from date of denial

- Claim submission within 12 months from newborn enrollment

- Claim submission within 12 months from primary carrier’s payments

- Claim submission within 12 months of third party liability payer exhaust denial (must provide dated denial)

If none of the above reasons apply, a Claim Filing Waiver Form may be submitted with one of the following documents that support attempts of earlier claims submissions:

- Copy of the electronic claim denial/rejection notification

- Dated correspondence from UHA with claim information detailing why claim was rejected

- Dated confirmation of claim receipt

When requesting a waiver, please use the Timely Claim Filing Waiver Form.

If you have any questions regarding timely filing, please contact Customer Services at (808) 532-4000, extension 351, from Oahu or (800) 458-4600, extension 351, from the neighbor islands.

Tip #3: Resubmissions, Corrections, and Reconsiderations

- What should you do if you are asked to resubmit a claim with notes?

- Submit a paper claim with medical notes attached and write “Resubmission” at the top right hand corner.

- What should you do if there is a denial on your claim that you disagree with?

- Complete and submit a “Claim Reconsideration Request” form along with your medical notes.

- Do not submit a claim with the “Claim Reconsideration Request” form to avoid a duplicate claim denial.

- What should you do if you would like to make a correction on a previously submitted claim?

- Submit a paper claim and write the words “Corrected Claim” at the top right hand corner.

- Please ensure that the corrected claim matches your original claim with the exception of the area(s) that is being corrected.See example below:

Original Claim

Corrected Claim

(Line 1: CPT changed to 99213 / Lines 2 & 3 identical to original claim)

What is UHA's Pharmacy Benefits Management Company?

UHA switched over to Express Scripts as of June 1, 2016 in response to customer feedback and our desire to rein in the skyrocketing costs of prescription drugs. In order for UHA to care for the needs of our members, we have to align ourselves with partners who will be able to help us curb costs. Because of its size and position in the industry, Express Scripts offers more competitive pricing and service for our members.

What is CareContinuum?

Some medications, such as injectables, infusions, and some specialty drugs are part of a member’s medical benefit rather than the pharmacy benefit. Express Scripts not only manages our pharmacy benefits for our members (PBM), but through their company CareContinuum, they can also manage medications under the member’s medical benefits (MBM). There is a MBM v. PBM Drug Lookup tool available here.

Where can pharmacists call for claims processing questions?

Pharmacists can call the Pharmacy Help desk at (800) 922-1557 to assist with claims processing for medications managed under the member’s pharmacy benefit (PBM) at any time of the day or night.

For help with claims processed according to the member’s medical benefit (MBM), pharmacists can call UHA Customer Services, Monday – Friday, 8am to 5pm Hawaii Standard Time, at (808) 532-4000, Toll free: (800) 458-4600.

What drugs are excluded?

Please see the list of excluded medications and their alternatives: Express Scripts.

My patient just changed plans to UHA. How will I know if my patient’s prescription medications require a prior authorization, if they are non-covered, or if they are non-preferred under their drug coverage?

We recommend that you visit uhahealth.com/express-scripts to see if there will be changes to the coverage of your patient’s medications:

- Which medications are included in our Formulary and which medications will require PA, step therapy, or have a quantity limit

- Which medications will not be covered

How do I enter PA requests for my patient's medications?

For fastest service visit Express Scripts’ provider portal at www.evicore.com/provider.

- This one-stop site will allow you to submit PA requests for medications managed under the member’s pharmacy benefit (PBM) and those managed under the medical benefit (MBM). In most cases you will be able to receive a real-time response. You can also set up email notifications which will send updates either on a daily basis, or if you prefer, only when a decision has been made.

- PA requests for medications that are managed under the member’s pharmacy benefit may also be submitted via covermymeds.

- Physicians may also call in PA requests for medications managed under the member’s pharmacy benefit (PBM) at any time of the day or night. And in most cases, you will get a real-time response.

- PBM Phone: (800) 753-2851

- PBM Fax: (877) 251-5896

- For PA requests for medications managed under the member’s medical benefit, call CareContinuum, the plan’s Medical Benefit Manager (MBM), Monday – Friday, 8am to 10pm Eastern Standard Time. Messages received after business hours will be returned the next business day.

- MBM Phone: (866) 877-7042 (Press Option #1 for PA questions)

- MBM Fax: (866) 877-7179

How can pharmacists check on PA status for patients prior to administering or dispensing?

Pharmacists may call the MBM or PBM phone number to obtain status on PA’s or check with the provider’s office who submitted the PA. The Pharmacy can register at www.evicore.com/provider also and submit PA’s. They can receive email notifications of status on a daily basis, or just when the decision has been made. Once ESI approves a PA, they will fax a notification to both the prescribing physician and the pharmacy listed on the PA.

- PBM Phone: (800) 753–2851

- MBM Phone: (866) 877-7042

How do I know which medications are managed under the member's medical benefit (MBM) and which are under the pharmacy benefit (PBM)?

Many injectable, infusion and specialty medications are managed under the member’s MBM rather than the PBM. Submitting PA requests via evicore.com portal eliminates the need to differentiate between the two. PA requests for drugs managed as a medical benefit or as a pharmacy benefit may both be submitted on the same user friendly website www.evicore.com/provider.

If you choose a different submission method, you can find out which medications are managed by the member’s medical benefit (MBM), and which are managed by the member’s pharmacy benefit (PBM) by using the MBM v. PBM Drug Lookup tool available on the Drug Search for Providers tab of the Find Care Providers & Drugs page.

What are UHA’s utilization management requirements?

These clinical programs protect your patient’s health and save them money: step therapy (ST), drug quantity management (QL) and prior authorization (PA):

Step Therapy

- Step therapy is a program for patients who take prescription medicine regularly to treat a long-term condition, such as arthritis, asthma or high blood pressure. It lets patients get the treatment they need affordably. It helps the plan sponsor maintain prescription-drug coverage for everyone the plan covers. In step therapy, medicines are grouped in categories based on treatment and cost.

- First-line medicines are the first step. First-line medicines are generic and lower-cost brand-name medicines approved by the U.S. Food & Drug Administration (FDA). They are proven to be safe, effective and affordable. Step therapy suggests that patients should try these medicines first because in most cases they provide the same health benefit as more expensive drugs, but at a lower cost.

- Second-line drugs are the second and third steps. Second-line drugs typically are brand-name drugs. They are best suited for the few patients who don’t respond to first-line medicines. Second-line drugs are the most expensive options.

- Members who are currently taking a second line drug will not be asked to switch to a first line drug. They will be grandfathered indefinitely.

- If you prescribe a new medication for a patient with a step therapy requirement, they will be asked to try a first-line medication before a second-line medication.

Drug Quantity Management

- The drug quantity management program makes sure that patients are getting the right amount of medication and that is prescribed in the least wasteful way. For example, you instruct your patient to take two 20mg pills each morning. If that medication was also available in 40mg pills, we would reach out to you about prescribing one 40mg pill a day instead of two 20mg pills. In addition, if you wrote the original prescription for 30 pills (a 15-day supply), the new prescription for 30 pills would last a full month — and the patient would have just one copayment, not two.

- This program also makes sure that the prescription doesn’t exceed the amount of medication that the plan covers. If the prescription is for too large a quantity, the pharmacist can fill the prescription for the amount that the plan covers or contact you to discuss other options, such as increasing to a higher strength or getting a prior authorization for the quantity originally prescribed.

Prior Authorization

- When a prescription requires prior authorization, you can submit a PA request to Express Scripts or prescribe a different medication that is covered by the plan.

How do I register for the eviCore.com portal?

Registration is quick and easy! Visit myevicoreportal.medsolutions.com/User/Registration/Index.

You can register with only 6 simple steps and log in right away to begin submitting PA’s online. A tutorial can be found here.

As a provider who submits prior authorizations, is there training information available for my staff to learn how to submit PAs?

Please see the evicore.com Web Portal Overview for step by step illustrations.

Where are the PA forms for medications?

With electronic prior authorization, spend more time with patients and less time faxing. Visit www.evicore.com/provider to submit PA requests any time day or night and in most cases receive a response right away.

How do I request an expedited review?

Using the online PA portal, www.evicore.com/provider, or submitting your PA via phone, is the fastest way to receive a response. In most cases you will receive a real-time answer, and if approved, the patient will be able to pick up their medications right away.

What if I want to appeal a decision made by Express Scripts?

If you disagree with a decision reviewed under the member’s pharmacy benefit (PBM), you may contact UHA’s Health Care Service Department Monday-Friday from 8am to 5pm HST to request a peer-to-peer conversation within 30 days of the denial. We will arrange a time for you to speak with our Medical Director or Chief Medical Officer to discuss reconsideration. If you would like to submit a formal, written appeal to UHA, please follow our appeals process described here.

If you disagree with a decision made by CareContinuum (MBM), please contact them at (866) 877-7042, Monday-Friday: 8am-10pm EST. With CareContinuum you will be able to request a peer-to-peer or submit a formal written appeal.

Do I have to call Express Scripts, or can I call UHA's customer service line?

Express Scripts can answer your questions quickly and accurately around the clock for questions about drugs managed under the member’s pharmacy benefit (PBM). For medications managed under the member’s medical benefit (MBM), any calls received outside of business hours will be returned the next business day.

UHA’s phone lines are also available from 8am to 5pm, Monday through Friday, except for major holidays. A representative can be reached at: 808-532-4000 (or 800-458-4600 from the neighbor islands) at the following extensions:

- Customer Services: ext. 297

- Health Care Services: ext. 300

- Employer Services: ext. 299

- Premium Billing: ext. 353

Express Scripts Contact Information

PBM:

- Member Customer Service: Specific number for member inquiries; listed on the back of the member ID cards.

Phone: (855) 891-7978

Available 24/7 - Prior Authorizations: Contact for physicians to call or fax in PHARMACY prior authorizations.

Phone: (800) 753 – 2851

Fax: (877) 251-5896

Available 24/7 - Pharmacy Help Desk: For pharmacy use only to assist with getting a claim to adjudicate or understanding a reject message.

Phone: (800) 922-1557

Available 24/7 - TDD: Member Customer Service number for hearing impaired members.

Phone: (800) 759-1089

Available 24/7

MBM:

- Prior Authorizations: Contact for physicians to call or fax in MEDICAL drug prior authorizations.

Phone: (866) 877-7042

Fax: (866) 877-7179

Mon – Fri 8AM – 10PM (EST), 2AM – 4PM (HST)

The forms and documents on this page require the free Adobe Acrobat Reader. Please download Adobe Reader.

We've temporarily re-organized our COVID-19 FAQs into the links below.

FAQs are now available as PDFs:

If you need further assistance, please contact Customer Services to speak to a representative.

- Phone: 808-532-4000

- Toll free: 1-800-458-4600

- Online: Leave us a message